MANUFACTURING PMI PLUMMETS: IMPLICATIONS FOR THE FUTURE OF THE U.S. ECONOMY

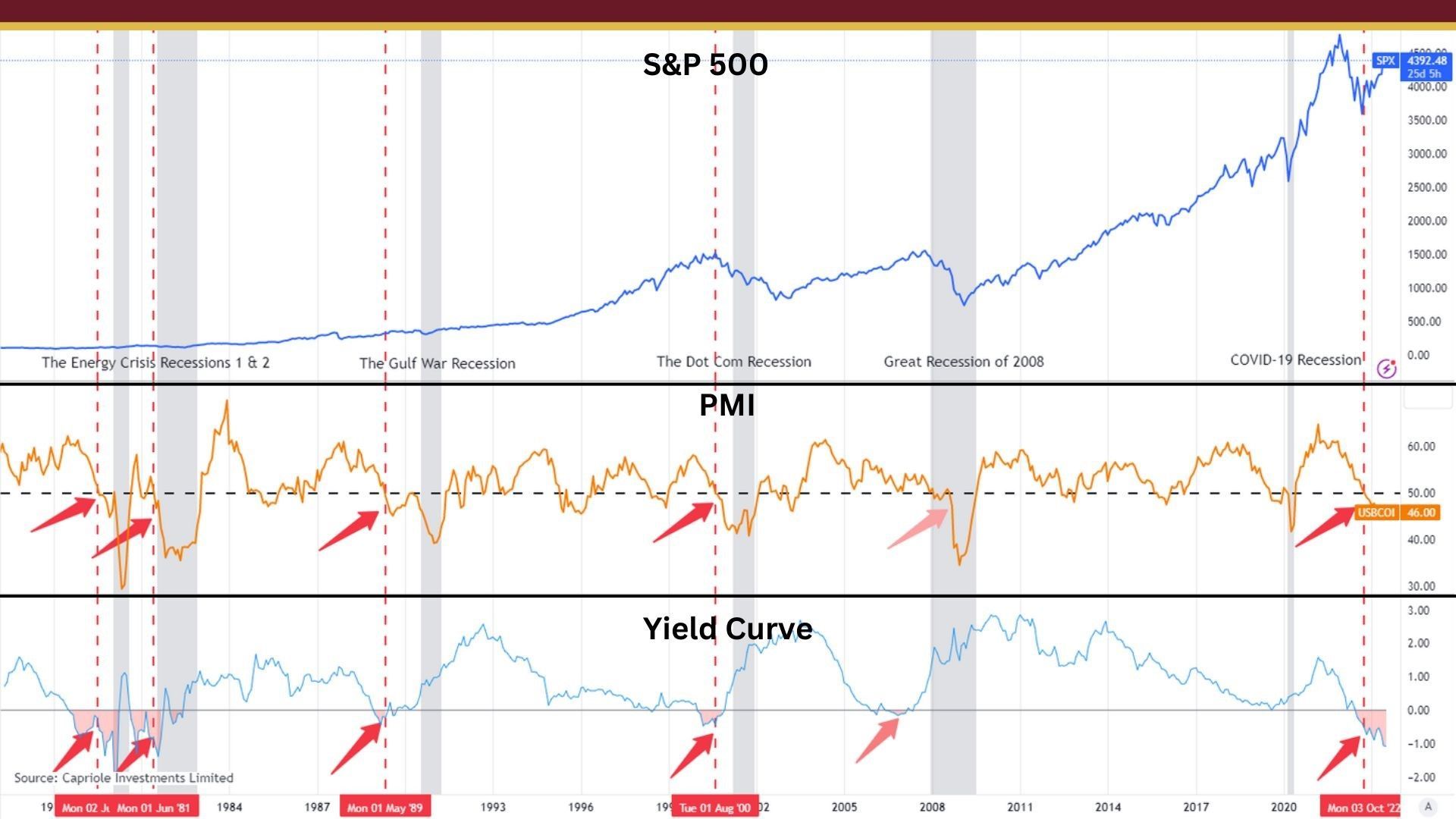

Are we headed for a recession? Recent data from the Institute for Supply Management (ISM) suggests so. In March, the manufacturing Purchasing Managers' Index (PMI) in the United States fell to the lowest level since May 2020, indicating a contraction in the sector for the fourth consecutive month.

This is significant because manufacturing is often viewed as a leading indicator of the economy's overall health. Additionally, OPEC's decision to cut oil production by 1.6 million barrels per day has sent oil prices soaring and could be a sign that the global economy is moving towards a recession. In this week’s economic update, we'll explore what these indicators mean for the economy and what steps you can take to prepare for potential changes in the market.

Manufacturing PMI for March

The ISM reported on Monday that its manufacturing PMI fell in March to the lowest level since May 2020. It was the first time since 2009 that all subcomponents of the manufacturing PMI fell below the 50 threshold. [1]

OPEC cut oil production by 1.6 million barrels per day

- Less energy needed to produce stuff because less stuff is going to be produced

- Less energy needed to ship stuff because less stuff is going to be shipped

- Less energy being needed so prices will fall - therefore reduce production to keep prices steady

In March, the Manufacturing PMI® was 46.3 percent, which is 1.4 percentage points lower than February's 47.7 percent. This means that the manufacturing sector in the United States has been contracting for the fourth month in a row after expanding for 30 months. This is the lowest Manufacturing PMI® reading since May 2020 when it was 43.5 percent. Below are some more detailed metrics from March's survey results [2].

- New Orders Index (measures the number of new orders received during a certain period of time) was at 44.3 percent, 2.7 percentage points lower than February's 47 percent.

- Production Index (measures the level of production activity) reading was 47.8 percent, which is a slight increase of 0.5 percentage points compared to February's 47.3 percent.

- Prices Index (measures the change in the prices of raw materials and supplies) was at 49.2 percent, down 2.1 percentage points from February's 51.3 percent.

- Backlog of Orders Index (measures the amount of work that has not yet been completed, but has been ordered and is awaiting production) was at 43.9 percent, 1.2 percentage points lower than February's 45.1 percent.

- Employment Index (measure of the number of employees in the manufacturing sector) was at 46.9 percent, down 2.2 percentage points from February's 49.1 percent.

- Supplier Deliveries Index (how quickly suppliers are able to deliver materials to manufacturers) figure was 44.8 percent, 0.4 percentage points lower than February's 45.2 percent, which is the lowest it has been since March 2009.

- Inventories Index (measures the level of raw materials and finished goods held in stock by manufacturers) was at 47.5 percent, which is 2.6 percentage points lower than February's 50.1 percent.

- New Export Orders Index (measures the number of new orders received from international customers during a certain period of time) reading was at 47.6 percent, 2.3 percentage points lower than February's 49.9 percent.

- Imports Index (measure of the amount of goods and services purchased from other countries by domestic companies) continued in contraction territory at 47.9 percent, which is 2 percentage points below February's 49.9 percent.

To put it plainly … these are further signs that the economy is slowing down. This shows that American factories are making fewer things because people are buying less. This is causing some companies to slow down how much they are making. It's not good news because this could mean that fewer people will have jobs.

Manufacturing is often considered a leading indicator of economic health because it involves the production of goods and equipment, which are used by businesses and consumers in other sectors of the economy, and a decline in manufacturing activity can lead to reduced employment and lower consumer spending, which can have a ripple effect throughout the economy.

Oil Production Being Reduced

You may have also noticed that the largest oil producing countries surprisingly decided cut oil production by 1.6 million barrels per day [3] and caused oil prices to spike above $80 per barrel. An analyst from Goldman Sachs said the OPEC+ move was unexpected but “consistent with the new OPEC+ doctrine to act pre-emptively because they can, without significant losses in market share.” [3]

It's important to think through what that means: They're pre-emptively taking action in order to maintain market share.

- OPEC+ countries want to keep oil prices at a good level for their economies, so they limit the amount of oil they produce to make sure there is not too much oil on the market.

- Reducing oil production can help countries maintain their oil market share by supporting oil prices. When they produce less, there is not enough oil for everyone who wants it, so the price goes up. This helps countries that sell oil because they can make more money.

Reading between the lines … these OPEC+ nations must believe that the global economy is moving toward a recession and the demand for oil is going to be reduced. For instance, energy is used in producing and shipping goods. Therefore, less energy will be needed to produce and ship goods.

As the market cycle continues through the contraction stage, the next logical step is for companies to start cutting back on their employees.

If that's the case, our goal at Abundance is to help you prosper regardless of the economy. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

Sources:

- https://www.reuters.com/markets/us/us-service-sector-slows-march-inflation-cooling-ism-survey-2023-04-05/#:~:text=WASHINGTON%2C%20April%205%20(Reuters),in%20the%20fight%20against%20inflation.

- https://www.prnewswire.com/news-releases/manufacturing-pmi-at-46-3-march-2023-manufacturing-ism-report-on-business-301787309.html

- https://www.cnn.com/2023/04/02/business/opec-production-cuts/index.html

Schedule a Discovery Call