FROM BOOM TO BUST: HOW A BANKING FAILURE CAN REVEAL THE HIDDEN RHYTHMS OF THE ECONOMY

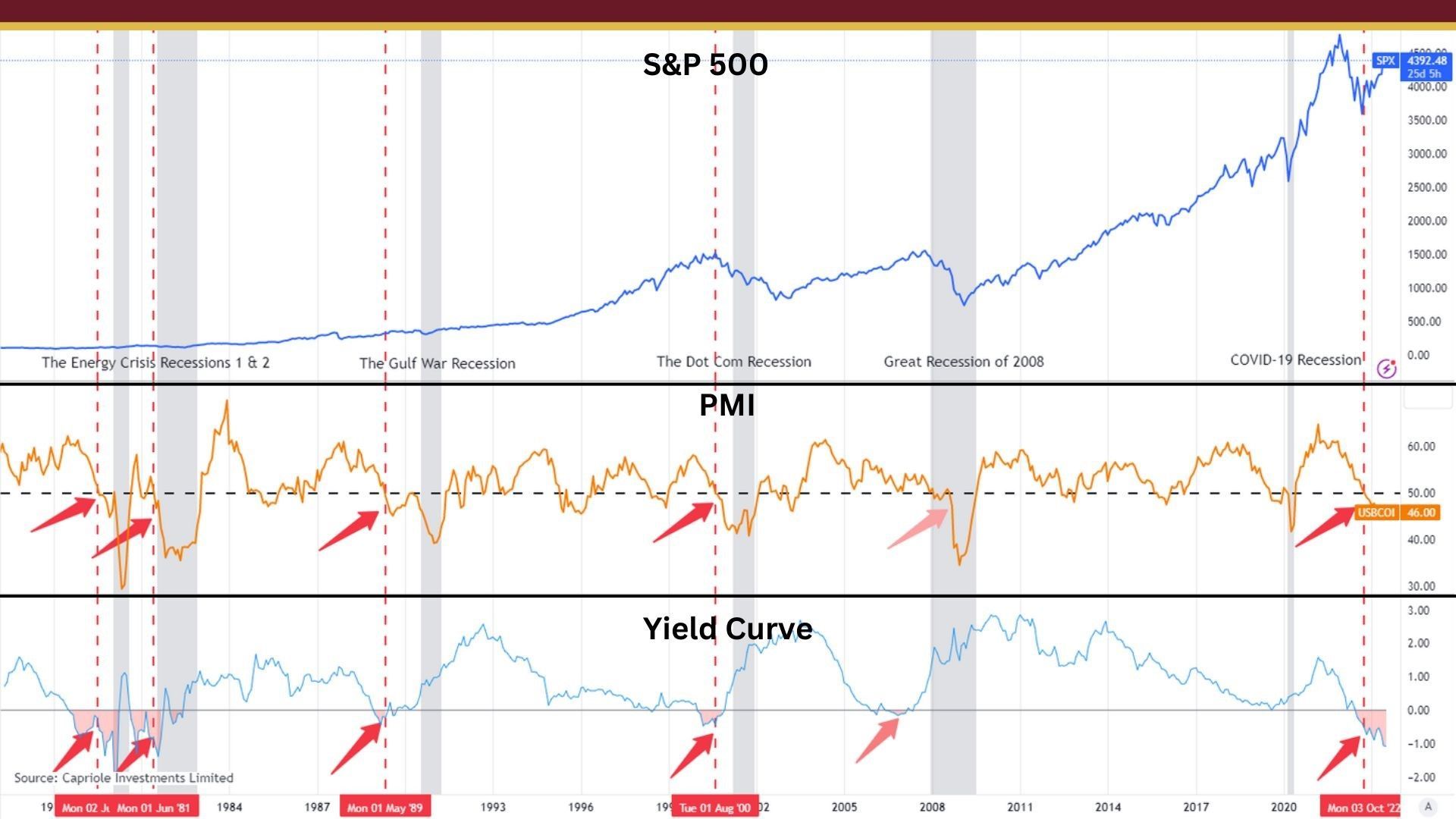

The business cycle is a complex phenomenon that describes the ups and downs of economic activity over time. At its heart, the business cycle is driven by the forces of supply and demand, as well as other factors like government policy, technological change, and global events.

One of the most dramatic manifestations of the business cycle is a banking failure, which can signal the beginning of a downturn and have far-reaching effects on the economy as a whole. Today, we will explore how a banking failure can highlight where we are in the business cycle and provide clues about what is likely to come next.

What Is The Business Cycle

The business cycle is a pattern that shows how the economy changes over time. It goes through different stages, from when it is doing really well, to when it is not doing so well. The business cycle has four main stages: expansion, peak, contraction, and trough.

- Expansion stage: During this stage the economy is growing and people are spending more money. This means businesses are making more profit and hiring more workers.

- Peak stage: This is when the economy is doing the best it can. At this point, businesses are making the most money and unemployment is at its lowest.

- Contraction stage: This is when the economy starts to slow down and people spend less money. Businesses start to make less profit and some people may lose their jobs.

- Trough stage: This is when the economy is doing the worst it can. This is when unemployment is at its highest and businesses are struggling to make a profit.

The business cycle is always changing and going through these stages. Understanding the business cycle can help us prepare for what's coming and make better decisions for our future.

Make Better Decisions By Keeping It In Perspective

Making the best decisions requires that you "watch the movie" instead of "looking at photographs". Let me explain using a story from the Titanic.

One of the most famous and enduring legends of the tragic sinking of the Titanic is the story of the band continuing to play while the luxurious ocean liner sank in the frigid waters of the Atlantic in 1912.

The Titanic had a seven-member band, led by Wallace Hartley, which was hired to provide entertainment for the passengers during the voyage. As the ship began to sink, the band members assembled on the deck to play music to calm the passengers and keep up their spirits.

Eyewitnesses who survived the disaster reported that the band played together until the very end, even as the ship tilted precariously and the lifeboats were being launched. Some accounts say that the band continued to play as the Titanic sank beneath the waves.

Now, here's the difference between "watching the movie" and "looking at photographs".

The image above is a picture from the 1997 film, "Titanic" [1].

Just looking at the image you may come to the conclusion that these three men are preparing for an important performance. The untrained eye would have no clue that these men are surrounded by the chaos of passengers fighting for their lives. It is very easy to come to faulty conclusions by simply looking at the image.

However, it is not difficult to understand what is happening when you've been watching the movie. You know that these men are on sinking ship, and the purpose of their music is an effort to calm frantic passengers who are fighting for their lives.

Banking Failures Can Signal The Contraction Phase

The contraction phase is often triggered by a shock to the economy, such as a financial crisis, a recession, or a natural disaster. During this phase, consumer and business confidence may decline, leading to a reduction in spending and investment. In the past couple of weeks there have been large banks across the world that have failed.

Yet, there are narratives that will spin the idea that "this time it's different".

In our photo versus movie analogy … those narratives are the equivalent of the photo.

Global banking failures have occurred throughout history and have been characterized by a variety of economic and financial developments. However, there are some common patterns and trends that have been observed in many of these failures. Here are three:

- Reduced lending: One common feature of global banking failures is a sharp contraction in credit and lending activities, as banks become more cautious and risk-averse. This can lead to a severe credit crunch, where businesses and consumers are unable to obtain the loans they need to finance their activities, leading to a decline in economic activity and rising unemployment.

- Bank runs: Another common feature of global banking failures is a significant increase in the number of bank failures and bank runs. As depositor confidence in the banking system erodes, people may start withdrawing their deposits from banks, leading to liquidity problems and potentially causing banks to fail. In some cases, governments may need to step in and provide financial support to prevent widespread bank failures and restore confidence in the banking system.

- Economic uncertainty: Global banking failures can also be characterized by a period of economic turmoil and uncertainty, as investors and businesses struggle to adjust to changing market conditions and shifting economic trends. This can lead to market volatility, currency fluctuations, and a decline in global trade and investment flows.

The recent bank failures seem like this could just be the beginning. At the time of this writing, PacWest bank has borrowed up to $15 billion as they saw a 20% decline in deposits [2], and there may be some early indicators that Capitol One Bank may follow suit with Credit Suisse [3].

Conclusion

Logically speaking, if these bank failures are signaling the contraction phase in the business cycle, then the trough phase is still ahead. The trough is the lowest point of the economic cycle, when the economy is at or near bottom, and growth rates begin to recover. Prices and inflation may begin to fall, and there may be some signs of deflation in certain sectors or industries.

This may take some time as GDP has been consistently slowing and there are estimates that the next two quarters could report negative GDP growth. If so, this would just be another sign that the economy is contracting and the trough of the cycle has not occurred.

Our goal at Abundance is to help you prosper regardless of the economy. Our Directional Portfolios aim to build a portfolio that will adjust with the business cycle. If you'd like to learn more, you can call or text at 678.884.8841 or email us at connect@findabundance.com.

Sources:

Schedule a Discovery Call