THE DELICATE BALANCE BETWEEN INFLATION AND LOW UNEMPLOYMENT

In Warren Buffet's 1986 Chairman's letter, he gave a unique insight into a piece of his strategy when it comes to entering and exiting his stock trades. Interestingly enough, it has nothing to do with timing or predicting market direction.

This is what he wrote about not having any stocks that meet his investing criteria.

"This statement in no way translates into a stock market prediction: we have no idea - and never have had - whether the market is going to go up, down, or sideways in the near- or intermediate term future. What we do know, however, is that occasional outbreaks of those two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. And the market aberrations produced by them will be equally unpredictable, both as to duration and degree. Therefore, we never try to anticipate the arrival or departure of either disease. Our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful." [1]

Reread the final sentence because it's worth reviewing.

His modest goal: simply be fearful when others are greedy and be greedy only when others are fearful.

If this is the case, now would be the time to think contrarian to the market because it's operating in a place of greed. According to CNN's Fear and Greed Index, the market sentiment has been in an area of extreme greed for most of February. [2]

Their fear and greed index have five different points of measuring the market sentiment: extreme fear, fear, neutral, greed, and extreme greed. As of this writing, the index is currently in the "greed zone".

At this point, you should be asking yourself: why?

Why is the market sentiment teetering between greed and extreme greed?

The Law of Cause and Effect

We don't believe that it's possible to know the exact reason but we do think there is enough evidence to come to a conclusion with conviction because we're all familiar with the universal law of cause and effect. The law states that every single effect within our world has an original starting point.

Let's assess a few things:

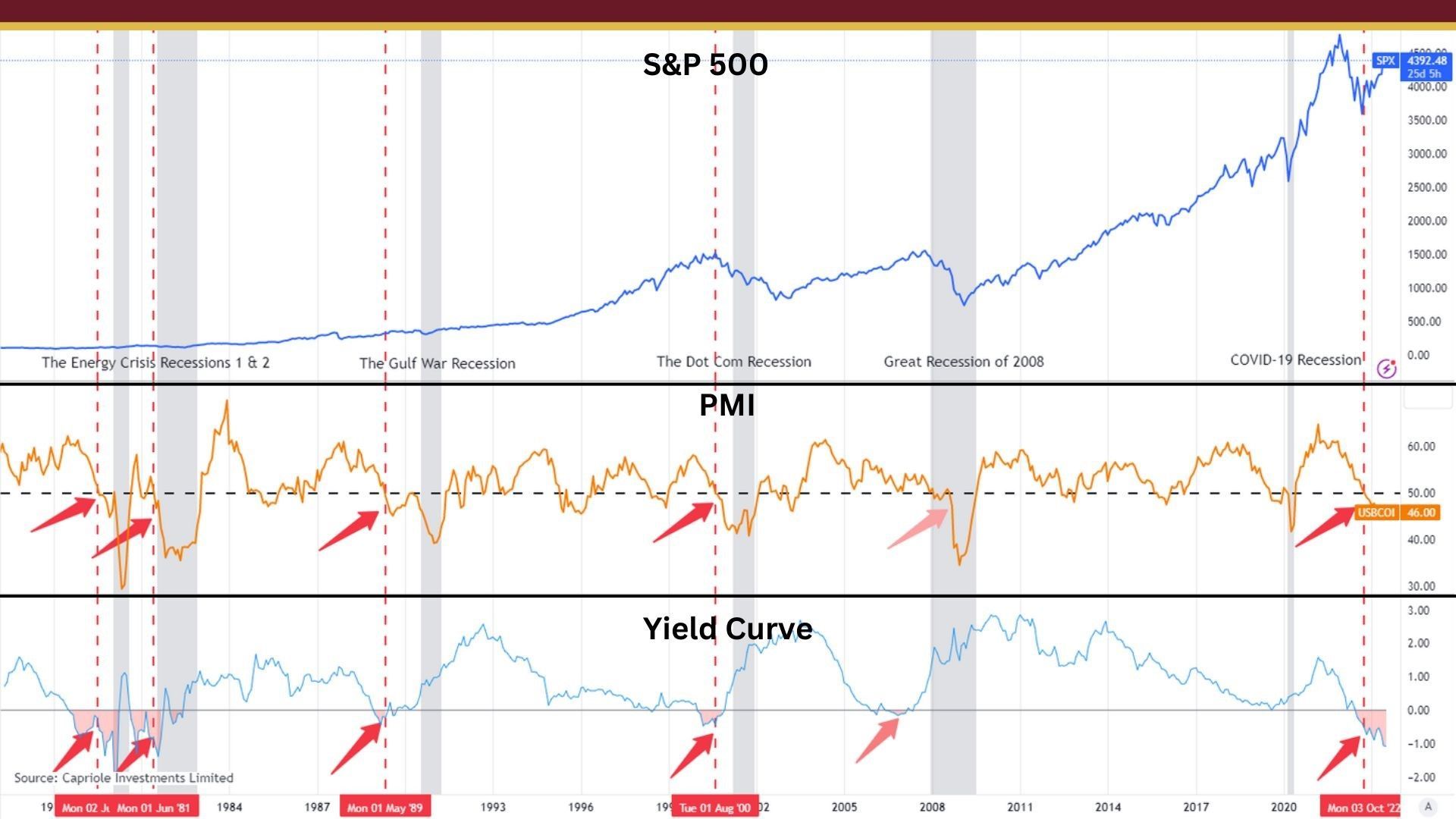

- 2022 was a difficult year for portfolio returns that left many investors afraid and grasping for hope as a recession seemed inevitable.

- Markets have sustained a positive rally since October 2022 with many people suggesting that the bottom of the bear market has taken place.

- Inflation has slowed and come down from the high of 9.1% in June which suggests that the Fed's aggressive increasing of interest rates is working.

- The January unemployment numbers were below the Fed's 4%-5% target for unemployment and suggests that the labor market is strong.

These are a few of the primary factors that are leading people to believe that the economy is fine and the Federal Reserve will change its stance on aggressively increasing rates.

This narrative is music to the ears of all the investors who are eager to see gains in their portfolio after a year where stocks and bonds both took a beating.

But we have to ask ourselves: does this position make sense? Is it realistic for inflation to get under control if the Fed pivots on increasing rates…especially in a low unemployment environment?

The Challenge of Low Unemployment

When the economy is operating at low unemployment, it typically means that there is high demand for labor, and therefore, high demand for goods and services. This high demand can lead to higher prices for goods and services, which in turn can contribute to inflation.

In addition, when unemployment is low, employers may have to pay higher wages to attract and retain workers. These higher wages can lead to higher costs of production, which can also contribute to higher prices and inflation.

Another factor that contributes to inflation is the level of government spending. When the government spends more money than it collects in taxes, it may need to borrow money by issuing bonds. This can increase the money supply, which can lead to higher inflation if the economy is already operating at or near full capacity.

In this scenario, raising interest rates may not be enough to bring down inflation if the economy is already operating with low unemployment, high demand for goods and services, and rising costs of production.

Therefore, the Fed shifting its stance on rising interest rates could encourage more consumer spending which naturally leads to an increase in the prices of goods and services.

We just don't see that happening because consumers are already struggling to keep pace at the current levels of inflation. In the final three months of 2022, we saw credit card debt hit an all-time high and delinquencies among borrowers accelerate.

Wilbert van der Klaauw, an economic research advisor at the New York Fed, said, “Although historically low unemployment has kept consumer's financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers' ability to repay their debts," [3]

On top of these concerns, many of the largest companies in the US have lowered their earnings projections since the beginning of the year. Among the S&P 500, 288 companies have had their consensus 2023 EPS lowered since the end of 2022.

That's 58% of the largest companies with negative revisions compared to 52% of the S&P 500 companies having positive earnings revisions this time last year. [4]

Our Modest Goal

In our opinion, there is wisdom in holding tightly to Warren Buffet's advice of being fearful when others are greedy. Our goal for Directional Portfolios is multi-faceted: 1.) We want to position the portfolio to be properly aligned with the overall economic cycle and 2.) We want to be on the right side of the market swings that take place inside that economic cycle.

Our modest goal is to build upon this proactive approach in order to be more agile for our clients in changing markets.

Links to sources:

- https://www.berkshirehathaway.com/letters/1986.html"

- https://www.cnn.com/markets/fear-and-greed

- https://finance.yahoo.com/news/troubling-signs-emerge-as-credit-card-debt-hits-record-high-160607906.html

- https://www.morningstar.com/news/marketwatch/20230214250/these-20-companies-are-bucking-a-mostly-negative-earnings-trend-heres-what-that-means-for-their-stocks

Schedule a Discovery Call